Quantum computing stocks are having a moment. The industry’s leading pure play company, IonQ (NYSE:IONQ), up nearly 400% year to date (YTD), has plenty of positive chatter about their proprietary technology. However, traders should avoid these three other quantum stocks that don’t have the same apparent potential.

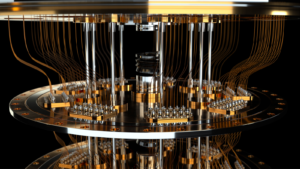

It’s important to realize that there are various ways to generate qubits and enable quantum computing. A pitfall is to value all these methods similarly. Yet, trapped ion approaches, used by IonQ and Honeywell (NYSE:HON), show the most promise. Others, such as superconducting and quantum annealing, are less proven to this point.

Avoid making any painful quantum computing mistakes and steer clear of these three riskier quantum picks.

Rigetti Computing (RGTI)

Rigetti Computing (NASDAQ:RGTI) is a small, pure play quantum computing firm focused on using superconducting technology to produce its qubits.

Researchers have noted that there are high error rates with superconducting transmon qubits. Efforts are under way to reduce the error rate in order to make superconducting a more competitive way of achieving quantum computing. For now, investors have gravitated to alternatives, such as trapped ion systems, used by rivals such as IonQ.

Rigetti enjoyed a brief moment in the sun this summer thanks to the superconducting media cycle. However, skeptics quickly debunked reports of a breakthrough in room temperature-based superconducting systems. This should put an end to the recent enthusiasm in RGTI stock.

At the end of the day, Rigetti is a tiny firm with minimal revenues attempting to popularize so-called second-tier quantum computing systems. All of that makes it a highly risky bet today.

Arqit Quantum (ARQQ)

Quantum computing and quantum technologies have started to make their impacts known in other industries. For example, Arqit Quantum (NASDAQ:ARQQ), is attempting to commercialize quantum encryption to deliver next-generation cybersecurity solutions.

On paper, this seems like a promising venture. The CEO, David Williams, has given investors an optimistic vision of the company, declaring in 2021 that Arqit could be “Britain’s biggest ever tech scale-up”.

However, another statement he made at the time has now backfired.

“We don’t need to raise any more money, ever,” Williams stated when Arqit’s SPAC deal was closing.

You can probably guess what happened next. That’s right, Arqit slammed investors with an unexpected capital raise earlier this year, causing the stock to careen 44% lower in a single day.

Perhaps quantum computing will be vital in developing future cybersecurity technologies. With little sign of it yet, Arqit is generating a disappointing $2.6 million of revenues through the first half of its latest fiscal year.

D-Wave Quantum (QBTS)

D-Wave Quantum (NYSE:QBTS) is a Canadian technology company attempting to commercialize its quantum computing systems. It has a fifth-generation quantum computer and offers quantum computing services on-demand, in addition to its Ocean open-source python tools ecosystem.

D-Wave uses a quantum annealing approach which it sees as optimal for solving energy-minimization problems such as optimization and sampling.

It should be noted, however, that most quantum computing firms have chosen other approaches, rather than quantum annealing.

In fact, it has little evidence of widespread customer interest. D-Wave’s Q2 earnings release showed just $1.71 million of revenues, which fell short of already modest expectations. Also, the revenue growth rate of 25% year over year (YOY) is quite unimpressive for a firm with such a small starting base of operations.

Perhaps quantum annealing will eventually take off. However, D-Wave’s current $175 million market capitalization seems awfully steep given the minimal revenues and fairly unproven nature of the technology.

On the date of publication, Ian Bezek did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.