Editor’s note: “Is This the Best Way to Invest in the AI Gold Rush?” was previously published in June 2023. It has since been updated to include the most relevant information available.

With everyone hyper-focused on artificial intelligence (AI) these days, investors are set on finding the best AI stocks to buy now.

It seems Wall Street thinks the answer is Big Tech.

So far in 2023, as the AI hype wave has swept across the stock market, Big Tech stocks have caught a bid. Moreover, they’ve actually rattled off record rallies.

Chipmaker Nvidia (NVDA) has become the “poster child” of the AI Boom. That stock is up more than 230% this year. Meanwhile, Meta (META) is up almost 150% in 2023. Amazon (AMZN) and Alphabet (GOOGL) are each up more than 50%. Apple (AAPL) and Netflix (NFLX) are up more than 40%. And Microsoft (MSFT) is up 37%.

Meanwhile, the Dow Jones Industrial Average – widely considered the benchmark of the U.S. economy – is up just 5% this year.

Of course, this begs the question: Are Big Tech stocks the best way to invest in the AI “Gold Rush”?

Put simply, no.

Big tech stocks are a way to play the AI Gold Rush. We believe companies like Microsoft and Apple will integrate sophisticated AI throughout their ecosystem of products. And chipmakers like Nvidia will see a huge uptick in demand for its GPUs to power next-gen AI systems.

However, those are multi-hundred-billion-dollar, even trillion-dollar companies. Even if their AI applications create trillion-dollar empires – which is totally possible but also a best-case outcome – their stocks would only rise, say, 100% to 200%.

Sure, a 100% return is nothing to sneeze at. My subscribers have been bagging near-100% winners all year long, and we’re very proud of that.

But the AI Revolution represents a once-in-a-lifetime investment opportunity where 1,000%, even 10,000% returns are entirely possible.

With opportunities that big available, we shouldn’t settle for 100% winners. We should think bigger.

And that’s why I think maybe the best way to invest in the AI Revolution today is through self-driving cars.

AI Drives AVs

AI is a technological tool, much like the internet is.

As technological tools, neither AI or the internet are all that valuable by themselves. Rather, in order to extract value from them – as is true with any tool – you have to apply it.

Apple applied the internet to the phone, created the iPhone, and built a nearly $3 trillion empire.

Amazon applied the internet to shopping, created e-commerce, and built a $1.4 trillion empire.

When looking to invest in AI, we cannot just invest in AI. We have to invest in companies that are innovatively applying AI to a huge industry, reshaping the way humans do things.

That’s why we think the best AI investment opportunity right now may be self-driving cars.

AVs Behind the Scenes

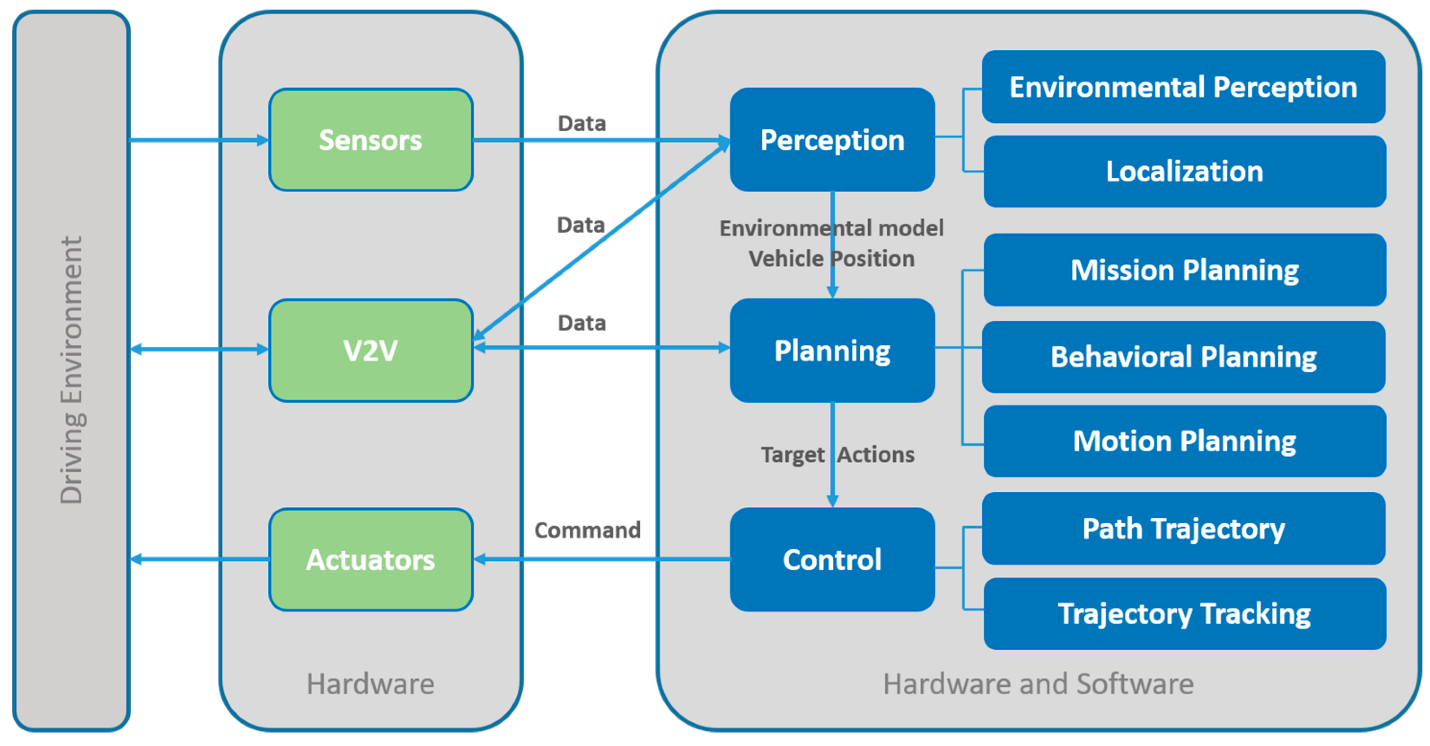

Autonomous vehicles are nothing more than AI applied to the world of transportation.

In a nutshell, here’s how.

A car is outfitted with sensors and cameras. Those sensors and cameras collect data about the car’s surroundings. That data is processed by an AI system, which it uses to make real-time decisions. And those decisions ultimately determine whether the car accelerates, brakes, changes lanes, turns, etc.

AI is the “engine” of the self-driving car.

Therefore, it is no coincidence that at the same time we are seeing all this hype about AI and ChatGPT, we are finally starting to see self-driving cars on the road.

Just this past week, I was in San Francisco, checking in with my tech industry connections. And while having a coffee with a colleague, a self-driving Waymo car zipped by us, with no driver in the front seat. It stopped at the corner stoplight behind another car, waited for the light to turn green and the car in front of it to start moving, then pushed forward and staged a seamless right turn before driving off.

Five minutes later, a different self-driving Waymo car drove by.

Five minutes later, yet another.

Throughout my first day in San Francisco, I saw more than a dozen self-driving cars zipping throughout the city.

And this isn’t just happening in the Bay Area.

Next time you fly into Phoenix Sky Harbor International Airport and order a ride-hailing service, you may be picked up in a fully autonomous vehicle with no driver in the car – at all. That’s because Waymo is also testing its self-driving cars in Phoenix, too.

Transportation 2.0

Waymo isn’t alone. Uber (UBER) recently said it will start its own robo-taxi services in Las Vegas this year.

And this extends beyond just ride-sharing.

Mercedes-Benz (MBGYY) said that later this year, it will launch a new line-up of vehicles with L3 autonomous driving capability. And it signed a multi-billion-dollar deal with autonomous vehicle tech firm Luminar (LAZR) to get the job done.

For context, Tesla (TSLA) cars only have L2 autonomous driving capability. And the gap between the two is wide. L2 requires constant human monitoring. But L3 allows drivers to safely watch movies, read, text, work on a laptop, and more while the car is in self-driving mode.

It’s a huge deal.

Self-Driving Is Taking Off

And yet again, it isn’t alone. Volvo (VLVLY) said it is launching a vehicle – the EX90 – with potential L3 driverless capability in early 2024. BMW (BMWYY) plans to launch one in 2024, and Volkswagen (VWAGY) plans to launch a full suite of them in 2025.

Meanwhile, you may have noticed all the recent news reports about self-driving delivery cars. You may have even had your stuff delivered by one recently. They’re everywhere these days!

In Houston, Domino’s (DPZ) is using small autonomous vehicles to deliver pizzas. Uber Eats is using its own autonomous vehicles to deliver food in Houston and Mountain View. Meanwhile, 7-Eleven is also using autonomous vehicles to deliver food orders in Silicon Valley.

Kroger (KR) – America’s largest grocer – has a fleet of autonomous cars to deliver groceries in Phoenix and Houston. FedEx (FDX) is testing out autonomous trucks in Houston, too. So is IKEA.

Folks. The self-driving cars have finally arrived. They are here!

It is no coincidence that their arrival is happening at the same time that AI is making massive advancements.

AI is the engine of the self-driving car. As AI is becoming infinitely smarter and better, self-driving cars are becoming infinitely more capable, too.

This multi-trillion-dollar revolution in transportation is happening right now.

And that’s why you should be buying self-driving stocks today!

The Final Word on Investing in AI

Everyone wants to invest in AI these days – and rightfully so. I think one of the best ways to do so is through self-driving car stocks.

I could tell you all day long why that’s the case. But showing is often more powerful than telling.

AI really burst onto the scene in 2023. Year-to-date, self-driving car stocks have soared anywhere from 5% to 200%, with the average return in some of our favorite self-driving car stocks we track being about 82%.

By comparison, the mighty Dow Jones Industrial Average is up just 5% this year.

Let me repeat that.

As AI has become the focus of Wall Street investors, self-driving car stocks have soared all while the mighty Dow is nearly flat.

And in our model portfolio, we are invested in what we believe are the best self-driving stocks in the market today. These are stocks that we think have 1,000%-plus upside potential.

And many of them are soaring this year. One is already up more than 160% in 2023.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.